how does maine tax retirement income

You should receive a 1099 form for anything over 600 in income but may. For tax years beginning on or after January 1 2016 benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

Is my retirement income taxable to Maine.

. For a retiree this. Maine allows for a deduction of up to 10000 per year on pension income. The income tax rates are graduated with rates ranging from 58 to 715 for tax.

For 2022 the 58 rate applies to taxable income less than 23000 for single filers and less than 46000 for joint filers. Recipients are responsible for state taxes in the state in which they reside. All residents over 65 are eligible for an income tax deduction of 15000 reduced by retirement income deduction.

According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. Kansas and Virginia. The 715 rate applies to taxable income over 54450 for.

31 on taxable income from 2501 to 15000 for single filers and from 5001 to 30000 for joint filers 57 on more than 30000 of taxable. Maine generally imposes an income tax on all individuals that have Maine-source income. The US Congress voted and approved in 1978 Title 26 US.

That was one of the largest tax cuts in the states history. Determine the Pension Income Deduction. State Income Tax Range.

June 6 2019 239 AM. In 2011 lawmakers lowered the income tax rate from 85 to 795. This is the amount subject to tax by the State you reside in.

You will have to. However that deduction is reduced in an amount equal to your annual Social. To enter the pension exclusion follow the steps below in the.

The 1099 form tells the IRS the total income you have earned from the individual or company that hired and paid you. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. What does Box 16 mean.

Permanently exempted groceries from the state sales tax in 2022. Maine has cut income taxes multiple times in recent years. The 10000 must be.

So you can deduct that amount when calculating what you owe. Retirement account contributions have special tax-favored status. So you can deduct that amount when calculating what you owe in taxes.

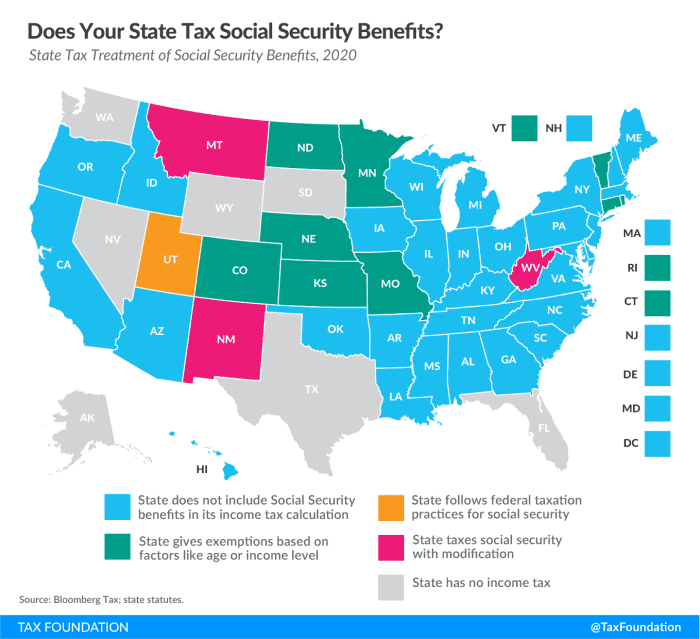

Retirement income The Back Story. Maine does not tax social security income. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

Subtraction from Income You will make a manual entry in tax software for. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. While it does not tax social security income other forms of retirement income are taxed at rates as high as 715.

First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Maine allows each of its pensioners to deduct 10000 in pension income. The state of maine has a business income tax.

States That Don T Tax Social Security

Retiring These States Won T Tax Your Distributions

Maine Retirement Guide Maine Best Places To Retire Top Retirements

List Military Retirement Income Tax

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

Which States Are Best For Retirement Financial Samurai

Maine Retirement Tax Friendliness Smartasset

Taxation Of Social Security Benefits Mn House Research

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Recent Changes To The Maine Income Tax Conformity Bill Wipfli

How Do State And Local Property Taxes Work Tax Policy Center

How Every State Taxes Differently In Retirement Cardinal Guide

Best Worst States To Retire In 2022 Guide

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

15 States That Don T Tax Retirement Income Pensions Social Security

![]()

Opinion New Tax Relief Plan Will Disproportionately Benefit Wealthy Seniors Maine Beacon